Fusion Coursework

IP Management & Commercialization (3cr)

This course seeks to provide students with the ability to value a given technological advance or invention holistically, focusing on issues that extend beyond scientific efficacy and include consumer and practitioner value propositions; legal and intellectual property protection; potential market impacts; market competition; and ethical, social, and practitioner acceptance. These issues transcend disciplinary boundaries, requiring the integration of expertise in the fields of law, management, and science.

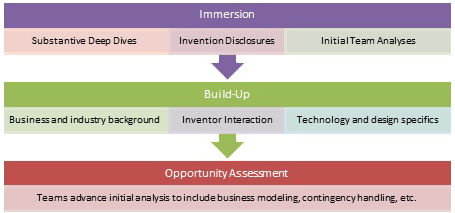

Students will learn that intellectual property strategy is implicit in technology-based business strategy, establishing strategic business assets that can be leveraged to create value in the marketplace. From this, students will learn to design an IP portfolio that aligns with a sophisticated business model, including market identification, value assessments, and a strong sense of the competitive landscape. This module exposes students to a range of issues related to the creation, management, and evolution of innovation and intellectual property estates. The focus of the course is to provide students the ability to discern value under multi-disciplinary lenses, leading to tactical approaches to commercial development and quantifiable value creation or go/no-go decision points. Primers in Intellectual Property Law, Finance and Scientific Substance will serve as the heart of the classroom-based curriculum. Meanwhile, the skills practicum will include risk analysis, modern approaches to valuing early-stage opportunities (i.e., decision tree analysis and application of Monte Carlo simulation techniques), and transactional approaches to collaboration/licensing.

New company formation and/or corporate partnering are two primary, although not exclusive, tools for bringing new innovations to market. In this skills-based course, students will learn the fundamentals of organizing a commercial development vehicle around a technology-based business model. Multi-disciplinary focal points will include:

Management – early-stage company organization, private financing fundamentals (i.e. angel and venture capital), business planning, organization building, and negotiation skills/approaches.

Law – primers on corporate law and securities offerings (public and private) will be the focus. In addition, students will learn the impacts of industry-specific regulatory frameworks (e.g., FDA, EPA).

Science/Engineering (e.g. genomics, chemistry, energy, biomedical engineering) – The fundamentals of organizing product development in the company context will be a primary focus, with students developing decision skills for in-sourcing/outsourcing, corporate partnering, and portfolio scalability decision. A secondary, but important tenet will be to impart to students an understanding of the ultimate customer/payor/practitioner framework that strongly impacts modern development in the global biomedical and energy industries.

Tangible outcomes/deliverables of this course will include the development of a formal business plan or partnering strategy that aligns to a tactical product development approach. When appropriate for a given technology opportunity, students will be exposed to implementation plans for commercializing a technology, leading to the creation of a securities offering for early stage finance.

.